With the exception of face-to-face visits from a wholesaler, new data from Cogent Reports™ reveal that across nine types of marketing outreach, digital approaches deliver the biggest lift in financial advisors’ provider consideration levels. Specifically, advisors exposed to the mobile apps, websites and webinars of leading asset managers have brand consideration levels that are at least 36 percentage points higher than those reported by advisors who have not had such exposure. These insights come from Q1 data posted to the Cogent Reports Advisor Touchpoints™ portal, which tracks the performance of the marketing efforts of the 15 leading mutual fund, ETF and VA providers. Cogent Reports is the syndicated division at Market Strategies International.

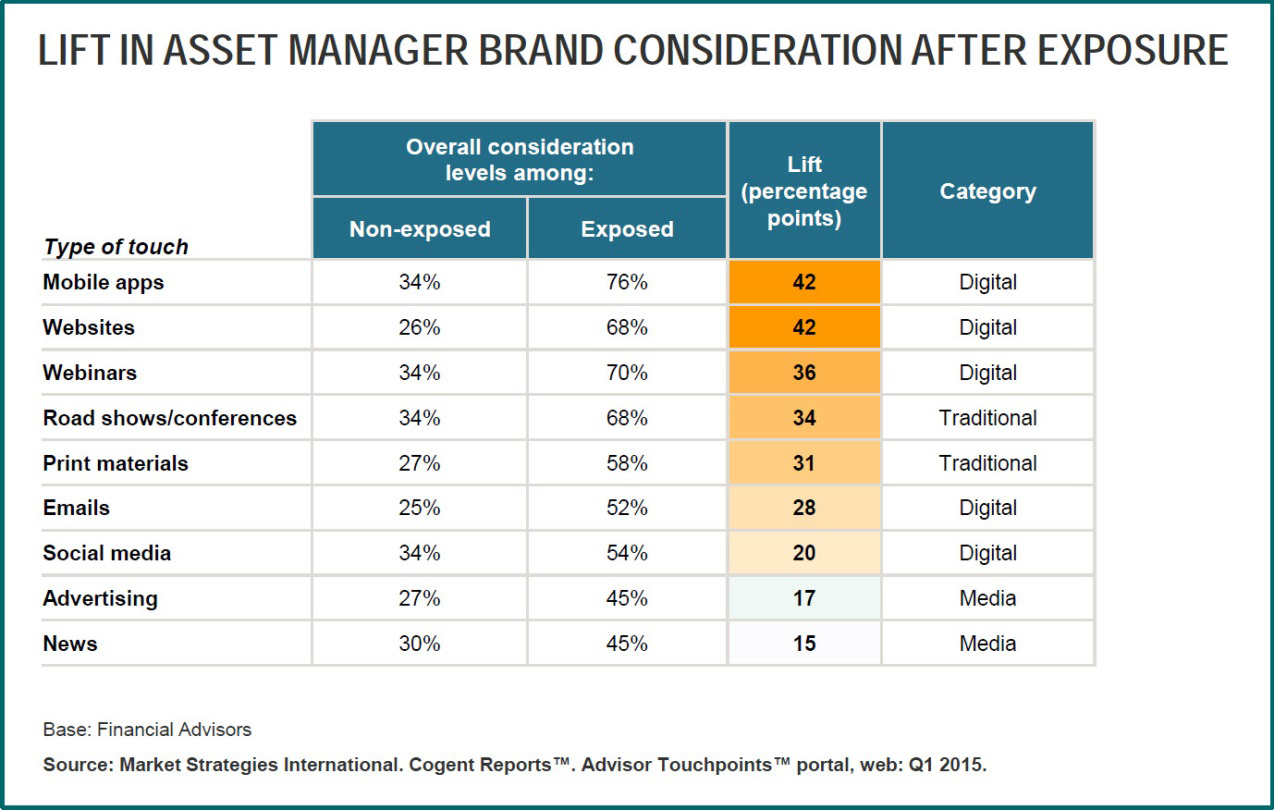

With the exception of face-to-face visits from a wholesaler, new data from Cogent Reports™ reveal that across nine types of marketing outreach, digital approaches deliver the biggest lift in financial advisors’ provider consideration levels. Specifically, advisors exposed to the mobile apps, websites and webinars of leading asset managers have brand consideration levels that are at least 36 percentage points higher than those reported by advisors who have not had such exposure. These insights come from Q1 data posted to the Cogent Reports Advisor Touchpoints™ portal, which tracks the performance of the marketing efforts of the 15 leading mutual fund, ETF and VA providers. Cogent Reports is the syndicated division at Market Strategies International. According to Cogent Reports, the average lift achieved across the nine touchpoints it tracks ranges from a low of 15 percentage points for news recall to a high of 42 percentage points for mobile apps and websites in Q1 2015.

On average, more than three-quarters (76%) of advisors exposed to asset managers’ proprietary mobile apps indicated they are likely to increase business with the firm, compared with only 34% of advisors who were not exposed (a 42-percentage-point lift). Similarly, two-thirds (68%) of advisors who visited an asset management website said they are likely to increase investments with the company, compared with just one in four (26%) advisors who did not visit those same websites. Ranked third in lifting consideration, webinars delivered a 36-percentage-point lift, with twice as many attendees being likely to consider investing in the sponsors’ product offerings (70% vs. 34%, respectively).

Across the 15 leading firms tracked by Cogent, the top firm by category in terms of achieving brand consideration lifts in Q1 with their digital strategies include State Street/SPDR among ETF providers (34-percentage-point lift), Jackson National Life for variable annuity providers (53-percentage-point lift), and American Funds and Franklin Templeton for mutual fund providers (47 and 46, respectively).

While mobile apps lead in terms of impact, not one of the providers tracked by Cogent Reports achieved penetration levels in excess of 5% with their mobile app offerings in Q1. Webinar penetration levels were only slightly higher, with the top performer reaching 6% of advisors. The more established marketing platform of websites range from a high of 45% advisor penetration to a low of 7%.

“The good news is mobile apps and webinars deliver remarkable results,” says Sonia Sharigian, senior product manager at Market Strategies. “The bad news is only small numbers of advisors are currently being engaged by asset managers via these methods.”

“Asset managers are missing the mark when it comes to capitalizing on this very powerful way to engage advisors,” says Christy White, managing director at Market Strategies. “However, with hard data that it works and low barriers to entry, this space has the potential to get very crowded, very quickly.”

Social media and news, the two touches which can be comprised of both company-sponsored and non-sponsored content, manage to deliver positive results, albeit on the lower end of the spectrum. Advertising delivered only a 17-percentage-point lift in consideration.

“Keep in mind, ad performance is highly dependent on the size of the ad spend, the quality of the ad spend, and the quality of the creative,” White adds. “While some providers achieve very high lift, most achieve moderate to low lift.”

No comments:

Post a Comment